Explore MortBuzz's EMI Calculator & Financial Tools

Choose according to your device to explore EMI calculator, EMI comparison, eligibility checker and CIBIL based ROI tools.

A Quick Guide On How To Use MortBuzz EMI Calculators & Financial Tools

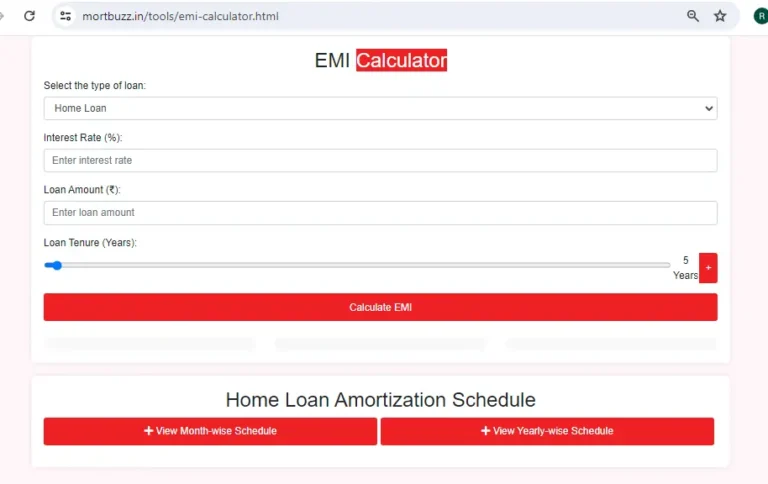

1. how to use MortBuzz EMI Calculator in 5 easy steps

Step 0 – click on desktop or mobile view from above

Step 1 – Click on “calculate EMI” under EMI Calculator

Step 2 – EMI Calculator will be opened, Now select the type of loan you are looking to calculate like personal loan, home loan or loan against property. Ex. Home loan

Step 3 – Enter interest rate that you want to calculate for Ex. 8.5 (%)

Step 4 – Enter the loan amount that you are looking for Ex. 1,00,00,000

Step 5 – Select the loan tenure you are looking to calculate Ex. 10 (years).

Now simply click on Calculate EMI, you will get Loan EMI, Total Interest Payable and Total Payment (Principal + Interest)

You can also view Principal, Interest, total payment and remaining balance in terms of months and years.

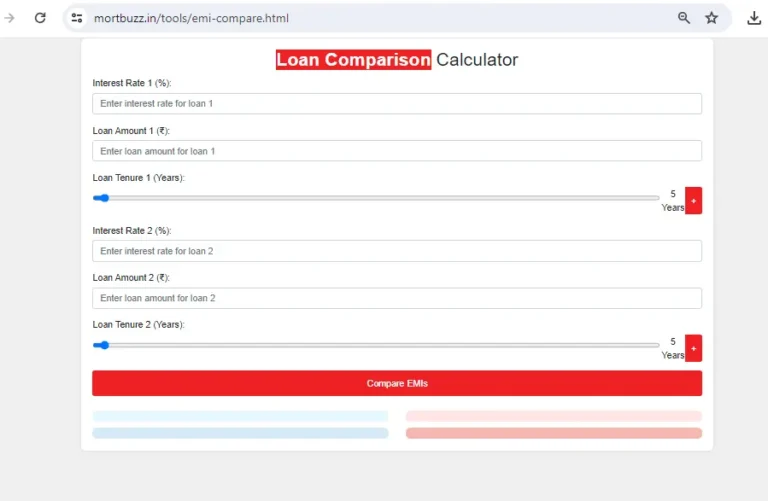

2. how to use MortBuzz Compare EMI tool

Step 1 – Click on “Compare EMI” under Compare EMI

Step 2 – EMI Comparison tool will be opened, Now select the interest rates, loan amounts and loan tenure for the loans you want to compare

Step 3 – Click on compare EMI, the 2 EMI’s will be compared with details like EMI, Month, Principal, Interest, total payment & remaining balance

3. how to use MortBuzz CIBIL Based ROI tool

Step 1 – Click on “Check ROI” under CIBIL Based ROI

Step 2 -CIBIL Based ROI tool will be opened, Now select the type of loan and enter your CIBIL score

Step 3 – Click on Calculate you will get estimated interest rates and the bank that you can apply loan with like Axis Bank, State Bank Of India, IDBI Bank, HDFC Bank etc.

4. how to use MortBuzz Eligibility Checker tool (COMING SOON)

Step 1 – Click on “Check Eligibility” under Eligibility Checker

Step 2 – Now enter some basic information such as CIBIL score, age, income, employment type and current on-going loan(s)

Step 3 – Click on check eligibility and it will show you if you are eligible for loan, what type loan you are eligible for and amount of loan you can aquire.

Frequently asked questions

An EMI Calculator is a tool that helps you estimate your Equated Monthly Installments (EMIs) for loans. You input the loan amount, tenure, and interest rate, and it computes your monthly payments.

- Simply input the loan amount, tenure, and interest rate into the EMI Calculator. It will then provide you with an estimate of your monthly payments.

Yes, the EMI Calculator can provide estimates for loan against property, personal and home loans.

The results from our EMI Calculator are highly accurate, providing you with a close estimate of your monthly payments. But we will recommend getting advice from a actual financial expert along with this tools.

Yes, you can compare EMIs for different loan amounts and tenures by adjusting the inputs in the EMI Calculator.

Our EMI Calculator does not have a maximum limit for loan amounts or tenures.

No, the EMI Calculator provides estimates based on the current interest rate you input.

Our EMI Calculator does not currently factor in prepayments or part payments.

Our EMI Calculator is updated regularly to reflect changes in interest rates inputs given by the user. the ROI (rate of interest) is given by the user.

MortBuzz's EMI comparison tool allows users to input loan details such as amount, interest rate, and tenure to compare EMIs across different loan options. It provides a clear overview of monthly payments for 2 different loan amount and/or interest rates, helping users make informed decisions.

Our EMI comparison tool simplifies the process of comparing loan options by providing accurate calculations and clear results, saving you time and effort in finding the best loan for your needs.

Our EMI comparison tool uses precise mathematical formulas to calculate monthly payments based on the provided loan details. While it provides accurate estimates, actual EMIs may vary slightly due to factors like taxes and additional fees.

No, our EMI comparison tool does not takes into account any additional fees and charges associated with the loan.

Absolutely! Our EMI calculator and financial tools is optimized for mobile devices, allowing you to conveniently compare loan options on the go. Just click financial tools for mobile view above.

CIBIL score serves as a crucial factor in determining the interest rate for your loan. Higher scores generally lead to lower interest rates.

MortBuzz regularly reviews and updates its interest rates based on market conditions and changes in credit scores.

Yes, Loan providers may offer special discounts or offers for customers with excellent CIBIL scores.

A low CIBIL score may result in a higher interest rate, but other factors are also considered in determining the rate.

A loan eligibility checker is an online tool that helps you determine your likelihood of being approved for a loan based on your financial information.

Our loan eligibility checker evaluates your financial details, such as income, credit score, and existing debts, to assess your eligibility for various loan products.

Factors such as income, age, employment, past loan history and net worth might be taken into consideration when determining my eligibility.